A new study on the eve of FoodTech Queensland has found Australian management is keen to pursue environmental excellence through green energy and waste water initiatives but wary of unproven operators who promise much while delivering little.

The study, commissioned by CST Wastewater Solutions, an exhibitor at FoodTech from June 26-28, finds industry is convinced about the potential financial viability of green energy and water quality initiatives, if sanguine about the failure rate in Australia and New Zealand so far.

“The survey is timely as we head into FoodTech where businesses will be looking at new products and technologies that are cost-effective and environmentally harmonious,” says CST Wastewater Solutions Managing Director Michael Bambridge, who commissioned the report. His company is involved in major food and beverage industry waste-to-energy projects in Australasia, details of which will be presented at FoodTech.

“It’s an important study, which we believe is the first of its kind in Australia, and it will help companies gain a greater knowledge of how management in the industry is perceiving sustainability outcomes. Merging sustainability and financial viability is crucial to success in this area,” said Mr Bambridge.

CFOs and engineering managers responding to the survey were particularly sceptical of “over-cooked” sustainability claims, and of vendors using ethicality as commercial leverage – urging buyers to spend for the sake of the environment while ignoring their real business needs. The market, by contrast, feels the sustainability industry should become more cost-effective, and be sure that business gets the results that they believe they have been led to expect and have paid for, says the survey report.

Mr Bambridge, who has more than 30 years’ experience in major waste water and green energy projects in Australia and the Asia Pacific, says such healthy scepticism is sometimes justified given the number of less experienced operators moving into the business as clean water and green energy become headline corporate issues.

“Too many fulsome promises have been made and accepted, possibly because they haven’t been subjected to sufficiently rigorous financial analysis using the same terms of reference for all parties. This makes it hard for those of us who present realistic proposals and later are left to clean up the mess created by others.

“But we are pleasantly surprised to see how Australasian management is responding positively to environmental challenges. The report is very positive,” said Mr Bambridge, whose company represents proven local technologies as well as advanced international technologies such as those of Global Water Engineering, which recently won the IChemE green energy award of an organisation representing more than 40,000 chemical engineering specialists.

“100% of our respondents strongly or somewhat agree that they are “passionate” about sustainability. We were expecting ambivalence around attitudes emanating from Chief Financial Officers and found some, though we found less ambivalence than expected.

Over 90% of respondents believe their CFO is receptive to sustainability initiatives with a strong cost justification,” he said.

The report, is the result of 60 in-depth interviews with senior executives in industries such as food, beverage, agribusiness, processing, resources and energy, which have the greatest potential for new technologies such as wastewater-to-biogas being introduced to Australia by CST.

The report shows respondents in Production, Engineering and Sustainability (PES) management have faith in the economics of sustainability investments, with over 90% disagreeing with the proposition, which is sometimes put, that sustainability is “never likely to be profitable”.

“Yet for over 50% of end-users and two thirds of the consultants we interviewed, there is a “major gap” between the goals and outcomes of Sustainability, while nearly all end-users we interviewed in person believe there are “major shortcomings” or even “failures” in sustainable energy and water projects, particularly around financial payback.

Continuing the picture of optimism towards environmental initiatives presented in the report, over 80% of respondents agree it is “a genuine investment priority” with almost 60% agreeing strongly, yet almost half feel it is at least to some extent a response to “politically correct pressure”.

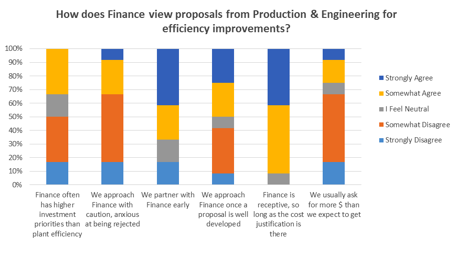

“Over 90% of respondents believe the CFO is receptive to sustainability initiatives with a strong cost justification, though a third agree that Finance has higher investment priorities than Sustainability. In the open comments for the survey on “major challenges” in Sustainability, a number of respondents said that raising its importance over other investment priorities was either their first or second challenge, while in the “Opportunities’ section many respondents cited business growth or new product development as their key Sustainability opportunity.

A number of PES managers candidly said that the first priority of the business was growth, in which context while environmental sustainability and energy efficiency came last – unless, as one respondent said, Federal policies change, and then it could be a whole new ball game.

CST Wastewater Solutions’ Managing Director Michael Bambridge, right, who recently installed a GWE combined green energy and wastewater treatment plant for one of Australia’s major global beef processers, Oakey Beef Exports.

“Another Chief Engineer described Environment and Sustainability as the “poor cousin” on the production side. So the responses are mixed, with a tendency for production and sustainability staff to be fairly optimistic about the CFO’s approach to their proposals.

“Respondents are divided on whether sustainability is ‘Efficiency management with a new name’ or something else, with half saying ‘yes’ and half more emphatically saying ‘no’, with 8% ‘neutral’.

“Yet 85% say it is a “much wider agenda than efficiency” and this tallies with the feedback from CFOs, as well as open responses indicating that even product innovation and growth are construed as being Sustainability”

Mr Bambridge said the study’s sample size is large enough for valid indicative reporting, particularly taking into account with the candid, in-depth nature of the research interviews. “This is in fact one of the most comprehensive reports of its type in recent times in which CFOs have been very willing to invest time to speak candidly about the subject, because they passionately feel it has been over-cooked by the supply side. The CFO’s position as custodian of the company’s financial well-being is often misunderstood. CFO’s are keen to field well-documented business cases for investments that are realistic and genuinely address risk management. This is borne out in our research with end-users and consultants.

“Given the level of scepticism and over-selling experienced by CFOs, and their responsibility for managing risks, staff and vendors should present objective business cases to CFOs, without ethical rhetoric.

“In particular, business cases should fully expose and explore financial, contract, technical and other risks and controls. An approach involving extensive due diligence – showing where it has worked elsewhere and what mistakes are commonly made – is a good way to cover concerns with senior management. For CFOs it is advisable to proactively partner with production and engineering staff using the sustainability manager as a conduit to make these expectations clear, and assist staff in meeting them. It is clear that sustainability appointments should be vetted by the CFO to ensure a close working relationship is tenable.” A full copy of the report can be viewed at www.cstwastewater.com/managing-sustainable-energy-water-investments.

For further information in Australia and New Zealand, , please contact Mr Michael Bambridge, Managing Director, CST Wastewater Solutions, 16/20 Barcoo Street, Roseville 2069. Tel: 61 2 9417 3611 email: info@cstwastewater.com www.cstwastewater.com